Discover the advantages of employee meal cards programs for both employers and employees. Explore types, tax benefits, implementation steps, and address concerns.

In today’s competitive job market, attracting and retaining top talent is paramount. Businesses are constantly seeking innovative ways to enhance employee satisfaction and offer valuable benefits. One such benefit that has gained significant traction is the employee meal card. This comprehensive guide explores the ins and outs of employee meal cards, covering their various types, benefits for both employers and employees, implementation strategies, and addressing common concerns.

What are Employee Meal Cards?

Employee meal cards are prepaid or voucher-based systems enabling employees to purchase food and beverages at designated merchants, including restaurants, cafes, and online food delivery services. They offer a convenient alternative to cash or personal credit cards, simplifying mealtimes and providing numerous advantages.

Types of Employee Meal Cards:

Understanding the different types of meal cards available is crucial for selecting the best fit for your organization:

- 1. Prepaid Meal Cards: The most common type, functioning like debit cards with a preloaded balance set by the employer. They offer flexibility and wide acceptance across various merchants.

- Features: Preloaded balance, wide acceptance, PIN protection, online/offline usage, balance tracking.

- Benefits: Convenience, flexibility, budgeting assistance, reduced administrative burden for employers.

- Limitations: Restricted to participating merchants, potential for loss or theft (though replaceable).

- 2. Employer-Issued Cards: Designed for use within a specific network of partner restaurants or food service providers, often offering exclusive discounts.

- Features: Partner network, exclusive deals, spending controls.

- Benefits: Cost savings through negotiated rates, enhanced employee satisfaction, support for local businesses.

- Limitations: Limited choice, requires negotiation with merchants.

- 3. Restaurant Cards: Specifically for use at the company’s in-house cafeteria or dining facilities.

- Features: In-house usage, cashless payment, prepaid or deduction system.

- Benefits: On-site meal convenience, cost control for employers, promotes in-house dining.

- Limitations: Limited to company premises, may offer limited variety.

- 4. Digital Meal Cards: Stored in mobile wallets or accessed through dedicated apps, offering enhanced convenience and security.

- Benefits: Enhanced security, instant issuance, seamless integration with mobile payment systems.

- Limitations: Requires employees to have smartphones or access to mobile wallets.

Choosing the Right Meal Card:

The ideal meal card type depends on your budget, employee preferences, and available dining options. Consider the features, benefits, and limitations of each before making a decision.

| Type of Card | Features | Benefits | Limitations |

| Prepaid Meal Cards | Preloaded balance, wide acceptance | Convenience, flexibility, budgeting, reduced admin burden | Limited to participating merchants, risk of loss/theft |

| Employer-Issued Cards | Partner network, exclusive deals | Cost savings, employee satisfaction, supports local businesses | Limited choice, negotiation required |

| Restaurant Cards | In-house usage, cashless payment | Convenience, cost control, promotes in-house dining | Limited to company premises, limited variety |

| Digital Meal Cards | Enhanced security, instant issuance, integration | Convenience, security, seamless mobile payment integration | Requires smartphones/mobile wallet access |

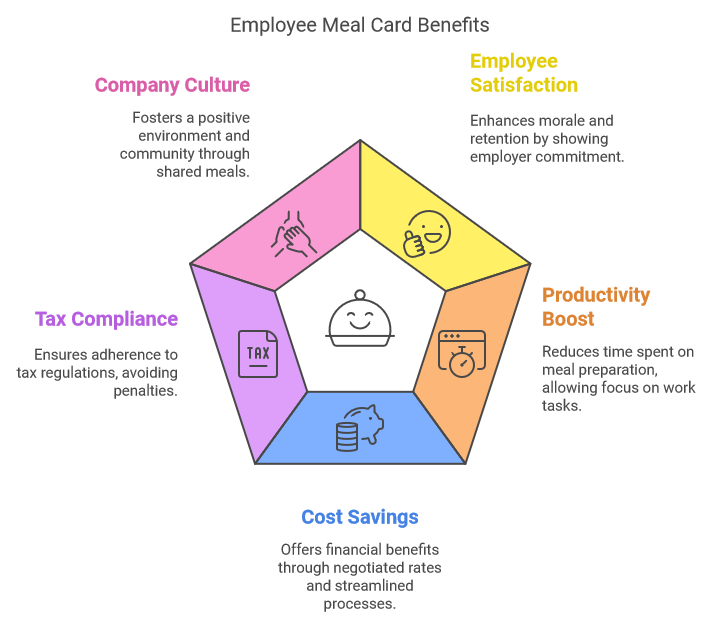

Benefits of Employee Meal Cards:

For Employees:

- Tax Savings: Meal allowances provided through meal cards are often tax-exempt up to a certain limit (e.g., ₹2,500 per month in India, potentially saving ₹30,000 annually).

- Convenience: Eliminates the need for cash or personal credit cards, simplifying meal purchases.

- Wider Food Choices: Access to a broader range of dining options compared to traditional methods.

- Improved Health and Nutrition: Potential for promoting healthier choices through partnerships with vendors offering nutritious meals.

- Better Budgeting: Preloaded balances facilitate better expense management and financial control.

For Employers:

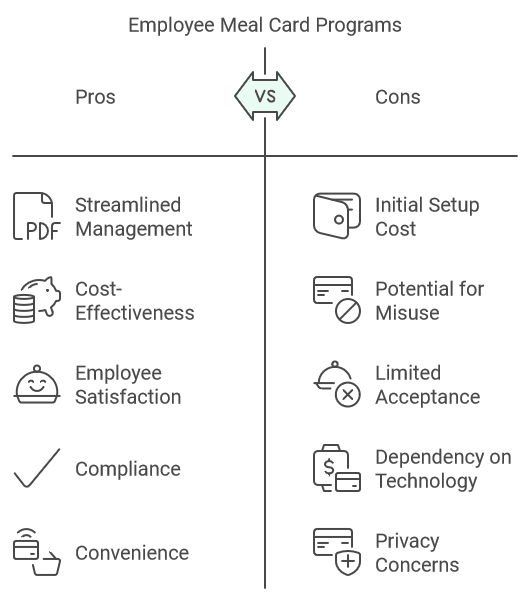

- Enhanced Employee Satisfaction and Retention: Demonstrates a commitment to employee well-being, boosting morale and loyalty.

- Increased Productivity: Saves employees time and reduces distractions related to meal planning and purchasing.

- Cost Savings and Administrative Efficiency: Streamlines meal allowance administration and potentially offers cost savings through negotiated rates.

- Compliance with Tax Regulations: Simplifies compliance with tax laws related to meal allowances.

- Improved Company Culture: Fosters a positive work environment and a sense of community.

Boosting Morale and Savings with Meal Cards:

Meal cards contribute significantly to employee morale by reducing financial stress, promoting a sense of value, offering convenience, and expanding food choices. The tax benefits further enhance their appeal, creating a win-win for both employers and employees.

Implementing an Employee Meal Card Program:

- Choose a Meal Card Provider: Consider network coverage, features, costs, and ease of management.

- Set Up an Account: Complete the necessary documentation and agreements with the chosen provider.

- Define Meal Allowance Policies: Establish clear guidelines for allocated amounts, distribution frequency, eligibility, and usage restrictions.

- Distribute Meal Cards: Provide clear instructions on activation and usage.

- Load Funds: Regularly replenish card balances based on established policies.

- Educate Employees: Conduct training and provide informational resources.

- Monitor and Manage: Utilize the provider’s platform for tracking, reloading, and managing cards.

- Gather Feedback: Continuously solicit employee feedback for program improvement.

Addressing Common Concerns:

- Security and Fraud: Meal card providers implement robust security measures like PIN protection, card blocking, transaction monitoring, and fraud detection algorithms.

- Merchant Acceptance: Providers build extensive partner networks and encourage employee feedback to ensure wide acceptance.

- Compliance: Reputable providers adhere to tax laws, data security standards, and relevant regulations.

- Lost or Stolen Cards: Easy reporting mechanisms, card blocking, and replacement procedures are in place, often with zero liability protection.

Meal Card Software:

Dedicated software streamlines program management with features like centralized dashboards, easy reloading and card management, real-time notifications and reporting, customizable spending limits, and integration with payroll systems.

Conclusion:

Employee meal cards are a powerful tool for enhancing employee satisfaction, simplifying administrative processes, and fostering a positive work environment. By carefully considering the various options and implementing a well-structured program, businesses can reap significant benefits while providing employees with a valuable perk. Ready to upgrade your employee benefits? Consider partnering with a reputable provider like Advance Technology Systems ( atsonline.in ) to implement a tailored meal card program that meets your organization’s unique needs.

We hope you enjoyed reading our blog posts about employee meal card solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91–9810078010 or by email at ats.fnb@gmail.com. Thank you for your interest in our services.

FAQs about meal cards:

- What are meal cards?

Meal cards are employer-provided prepaid cards that are similar to debit cards. Employees can use them to buy food and groceries at a variety of places. Think of them as a dedicated card just for food expenses. - Why are meal cards important for businesses?

Meal cards can make employees happier in a few ways. First, they offer tax benefits, which can increase take-home pay. Second, they streamline food expenses by providing a separate card just for those costs. This can make budgeting and tracking easier. Finally, offering a meal card shows employees that their company cares about their well-being, making for a more attractive benefits package. - What are the main advantages of meal cards for employees?

The sources list several advantages for employees, including:

- Tax Benefits: Meal cards are often exempt from income tax up to a certain limit. This reduces your taxable income and can mean more money in your pocket.

- Convenience: Meal cards eliminate the need to use cash or your personal debit card for food purchases. This can simplify expense tracking and budgeting.

- Freedom of Choice: You can use your meal card at a network of restaurants, food chains, and retail outlets, offering a variety of food options.

- Reduced Lunch Stress: You can save time and effort by ordering food with your meal card instead of packing lunch every day.

- Food Expense Management: Meal cards come with preset limits, helping you manage your food spending.

- No Reimbursement Hassle: You don’t need to go through a reimbursement process for food purchases made with your meal card.

- Easy Management: You can easily manage your meal card online, check your balance, and see when it expires.

- How can meal cards benefit employers?

From an employer’s perspective, here are some of the benefits of offering meal cards:

- Employee Retention: Offering meal cards as part of a compensation package makes it more attractive and can help retain employees.

- Increased Productivity: Employees who don’t have to worry about preparing lunch can focus more on their work.

- Easy Management: Employers can streamline meal allowances and reduce the hassle of food coupons and reimbursements.

- Competitive Advantage: In a competitive job market, offering meal cards can set a company apart and make it more appealing to potential hires.

- Are there different types of meal cards?

Yes, the sources describe three main types:

- Prepaid Meal Cards: These are general-purpose cards that can be used at various restaurants, convenience stores, and food outlets. They offer employees the most flexibility.

- Employer-Provided Meal Cards: These cards are offered through partnerships between employers and specific restaurants or food providers. They can only be used at the designated locations.

- Restaurant-Specific Meal Cards: These cards are issued for use at a company’s in-house cafeterias or dining facilities. They are the most restrictive in terms of usage.

- Are meal cards taxable?

Meal cards are generally not taxable. However, in India, if the amount spent on meals exceeds the non-taxable limit of 2200 INR per month, the excess amount becomes taxable under Section 17(2)(viii) of the Income Tax Act.

How can meal cards help prevent fraud?

Meal cards have security features that can help prevent fraud. They typically require a PIN for transactions, making it difficult for unauthorized users to make purchases, even if they find a lost card. Additionally, the finance team can easily block a card that’s been reported lost, preventing any further fraudulent activity.